Comprehensive Review dedicated to traders from South Africa

FXGT Review South Africa

Accepts South African Clients

Who is FXGT?

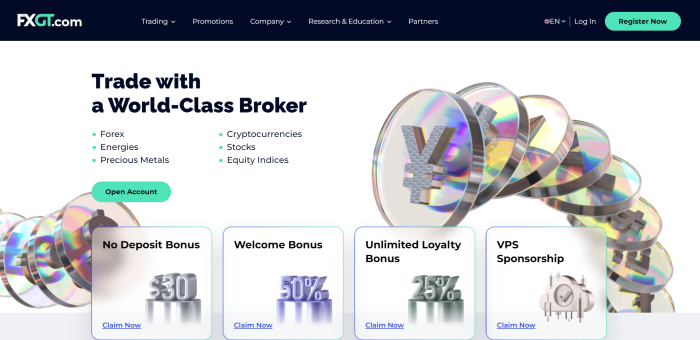

FXGT.com, an FSCA-regulated broker established in 2017 offers a wide array of market products for traders to invest in. These include forex, stocks, precious metals, cryptocurrencies, and indices. Furthermore, the broker provides access to two high-quality trading platforms, MetaTrader 4 and MetaTrader 5. Noteworthy for South African traders is the access to one of the highest leverages available in the market, reaching up to 1:1000, enabling traders to command substantial positions.

With a minimum deposit requirement of just $5, FXGT.com offers affordability that suits most South African traders.

Regulated by:

FSCA

Financial Sector Conduct Authority, based in South Africa, license no 49970.

FSA

Financial Services Authority, based in Seychelles, license number SD019.

VFSC

Vanuatu Financial Services Commission, based in Vanuatu, license number 700601.

Risk warning: Remember that forex and CFDs available at FXGT are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Pros

(*Subject to different regions and T&C)

Cons

01

Trading assets

FXGT.com allows its traders to invest in various global markets under the same account. Here, traders have access to market instruments from 7 different asset classes all of which are CFDs. Let’s take a look at the market products available to trade on this broker site:

- Forex – CFDs on forex currency pairs are available to buy and sell on the FXGT.com broker site. The collection of forex pairs is diverse including majors, minors, and exotics.

- Equity Indices – Several equity indices are also available to trade as CFDs. Under this asset class, traders have access to indices like the US30, AUD200, UK100, and US500, among others.

- Stocks– Traders on FXGT.com can also buy and sell the stocks of some of the world’s biggest and most popular companies. These include companies like Apple, Amazon, AIG, Meta, and eBay, among others.

- Cryptocurrencies – CFDs on cryptocurrencies like Bitcoin, Ethereum, Litecoin, Cardano, and Ripple, are available to trade on their platform. There are several other crypto assets available, allowing traders to diversify their portfolios.

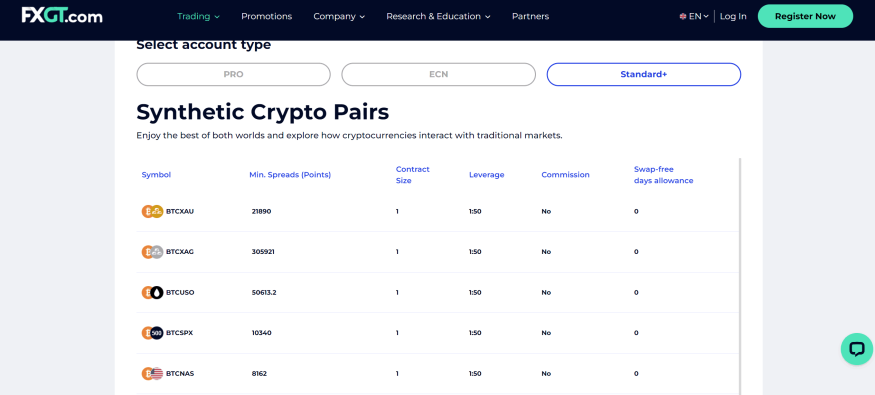

- Synthetic Cryptos – This asset class allows individuals to speculate on how cryptocurrency prices interact with other traditional markets. For example, traders can speculate on how Bitcoin interacts with Silver, Gold, or even the Dow Jones Index.

- Energies - Further, traders can trade different Energy assets such as crude oil and natural gas.

- Precious Metals - Finally, investors have access to two main precious metals to trade which include silver and gold.

Available Deposit & Withdrawal Methods

FXGT.com supports a variety of payment options for

deposits and withdrawals. Below are some of the methods the broker supports.

Supported Platforms by FXGT

There are two main trading platforms available on FXGT.com.

These include:

02

Trading Platforms of FXGT.com

We cannot overstate the importance of the trading platform that an investor uses in the market. The trading platform needs to be fast enough to keep up with the fast-paced financial markets. On top of that, the trading platform needs to provide tools that make the trading process easier for traders.

Luckily, FXGT.com provides South African traders with two of the best trading platforms in the market today. On this broker site, traders have access to both MetaTrader 4 and MetaTrader 5. Produced by MetaQuotes Software, these platforms have intuitive interfaces suitable for both beginners and advanced traders.

Moreover, both platforms are equipped with an extensive array of trading tools for traders to leverage. MetaTrader 4 offered by FXGT.com boasts 30 diverse indicators, 9 chart timeframes, 3 order execution types, one-click trading, and a host of other features.

Furthermore, this platform supports the utilization of Expert Advisors (EAs) for automated trading and analysis, enhancing traders' capabilities.

On the other hand, MetaTrader 5 comes packed with even more tools. On this broker site, it has one-click trading, 38 different indicators, 4 order execution types, and 21 different chart timeframes. Additionally, the newer MetaTrader 5 gives traders access to more market instruments.

MetaTrader 4 only allows traders to access forex and CFDs. In contrast, MetaTrader 5 gives traders access to forex and CFDs alongside stocks, futures, and options. On a positive note, both of these platforms are available on all kinds of devices including Desktop, Web, Androids, macOS, and iOS.

Screenshot taken from the official website of FXGT, page synthetic crypto pairs

Did you know?

FXGT is one of few brokers that supports trading on synthetic cryptocurrencies allowing traders

to trade cryptos against NASDAQ, Apple and other popular assets.

03

A Review of FXGT’s Trading Fees

FXGT.com provides traders with four different accounts to choose from. These include the Standard, the Mini, the ECN, and the Pro accounts. The spreads that traders enjoy on this broker site depend on the account that a trader chooses. The Standard account and the Mini account both provide traders with spreads that start from as low as 1.0 pips for major currency pairs with no commission paid.

On the other hand, the Pro account features slightly lower spreads that start from as low as 0.5 pips without commissions. Finally, the ECN account features spreads from as low as 0.0 pips with a commission depending on the asset class. The commission is $6 per round turn when trading forex classes, $5 per round turn on all precious metals, and 0.1% per round turn on all cryptocurrency assets.

Other than the spreads and commissions, FXGT.com also charges swap fees on any positions left open overnight. The fees charged depend on the asset being traded and the size of the position a trader is holding. On a positive note, this broker has swap-free days allowance on some assets on some accounts.

For example, forex, metals, equity indices, and energies are swap-free for 6 days a week on the pro account. The standard and the mini accounts do not have any swap-free days for any assets. Nonetheless, swap-free accounts are available for Muslim traders who cannot pay overnight charges due to religious restrictions.

04

FXGT.com Research and Education Section

Access to educational resources on a broker site can help put traders in a better position in the market. Education arms traders with the knowledge they need to approach the markets with confidence and from an informed standpoint.

FXGT.com provides an education section that mainly contains ebooks on various trading topics. These topics range from basic lessons to more complex concepts in market analysis.

Further, the broker provides traders with access to a research and insights section that can help traders in their decision-making process.

Traders have access to trader insights, MQL5 trading signals, technical analysis on various trading pairs, and much more.

Also, with the new Blog section, aimed at enhancing the trading experiences of traders worldwide, expect a curated collection of articles and market analysis.

Whether exploring trading strategies or staying informed about market trends, the section aims to provide you with valuable resources to enhance your trading knowledge and confidence.

Did you know?

FXGT is locally regulated in South Africa by the Financial Sector Conduct Authority.

05

FXGT.com Customer Support

Customer support is a crucial feature to look at when picking a broker to trade with. It should be easy to reach a broker whenever there is a problem. Luckily for South African traders, FXGT.com has several channels that traders can use to reach the support team with any questions.

First, traders can chat with the team via the live chat feature for quick responses. Further, they can escalate any serious problems by contacting the company via email, at support@fxgt.com. Notably, customer support on FXGT.com is available 24/7 and in several languages.

06

FXGT.com Promotions

FXGT.com offers currently its traders four different promotions they can take advantage of. For starters, this broker offers clients a $30 no-deposit bonus for new traders provided they verify their accounts within 30 days. To verify one’s account, clients only need to complete the KYC process and then they can claim their bonus within the Client Portal. This bonus is only available for Mini and Standard+ accounts.

On top of that, the broker also offers a 50% welcome bonus of up to $500 on a trader’s first single deposit. Notably, when a trader deposits anything equal to or below $1,000, they will receive the full 50% bonus. However, any deposit above $1,000 will only receive a bonus of $500. Just like the $30 no-deposit bonus, this 50% bonus promotion is only eligible on the Mini and the Standard+ accounts.

Further, FXGT.com has a 25% loyalty bonus of up to $10,000 that has unlimited resets. This loyalty bonus gives traders a 25% bonus on all direct deposits into their Mini and or Standard+ accounts until they reach the bonus limit of $10,000. Once a trader exhausts the limit, the broker resets it back to zero provided a trader meets the conditions. The conditions include having made at least 1 trade within the past 30 days and completing a cumulative trading volume of 40 GTLots.

The fourth and final promotion on this broker site is the VPS sponsorship program. This program allows traders to power up their trades with VPS Hosting. Traders get 24/7 access to high-speed servers that keep their EAs running offline. This means that traders enjoy uninterrupted trading and lightning-fast speeds when trading. Overall, the VPS minimizes order execution latencies to near zero.

(*Subject to avability, T&C apply)

07

Leverage

FXGT.com offers South African traders one of the highest financial leverages by any broker. The leverage goes up to 1:1000. However, the broker has a leverage model that adapts in real time depending on the trading position. There are tiers depending on the trading volume that determine how much leverage a trader can access. The leverage also depends on the type of instrument being traded and the risk profile associated with each asset class.

This dynamic leverage offered by the broker is a risk management tool to protect trader accounts from excessive exposure, especially when trading high volumes. It balances risk appetite while enabling traders to maximise their trading potential. As an example, let’s look at the different leverage levels for major currency pairs. Tier 1 traders are those with trading volumes between $0 to $800,000. Traders in this tier enjoy leverage of up to 1:1000. Tier 2 traders are those with trading volumes of between $800,000 to $2,500,000. These traders have access to leverage of up to 1:500. Finally, traders with trading volumes above $2,500,000 can access leverage of only up to 1:100.

However, the maximum leverage for each asset class differs as outlined below.

Forex 1:1000

Precious Metals 1:1000

Cryptocurrencies 1:500

Equity Indices 1:100

Energies 1:100

Synthetic Cryptocurrencies 1:50

Stocks 1:50

Expert's cricital opinion

FXGT.com comes out as a well-established broker with a range of trading products for South African investors. With FSCA regulation, South African traders can invest with broker with a confidence they would not have with a broker missing the FSCA’s regulation. The availability of MetaTrader 4 and MetaTrader 5 platforms ensures a streamlined trading experience supported by a wide array of tools and indicators.

Nonetheless, to fully evaluate this broker, we must pin it against other leading competitors. For this FXGT.com review, we decided to compare it to Exness and XM. Overall, the broker competes well in terms of regulations. Since it has regulations by the FSCA, its reputation is good in the country. Exness would also be in favor of South African traders due to its FSCA regulation in the country. While XM does have regulations by the FSCA, it onboards traders from the country using its FSC-regulated entity, which can be an issue for some traders.

However, XM beats out both Exness and FXGT.com when we look at the trading instruments available. On the XM broker site, traders have access to over 1,000 different market products. In contrast, Exness features a total of just over 200 products and FXGT features slightly over 150 products. All the brokers offer MetaTrader 4 and MetaTrader 5 which are two of the best platforms to use in the market.

Finally, the spreads on FXGT.com are market standard starting from 1.0 pips on its standard account. XM also features spreads from 1.0 pips on its standard account. However, XM ‘s ultra-low account features lower spreads from 0.6 pips. Exness offers the lowest spreads on its standard account from as low as 0.3 pips. Nonetheless, both FXGT.com and Exness allow traders to access accounts with spreads from 0.0 pips plus small commissions involved.

Peter Cook Ndungo

Editor, Senior Broker Analyst