HERE IS A LIST OF BEST FOREX BROKERS THAT WORK WITH MOBILE MONEY IN AFRICA

Forex Brokers That Accept Mobile Money

In recent years, the African continent has witnessed a surge in the adoption of mobile money services. These services have revolutionised the way financial transactions are conducted. Mobile money has transformed the lives of millions by providing access to basic financial services. It has also penetrated into the world of forex trading where forex brokers now integrate mobile money as one of the supported payment systems. This shift has made forex trading more accessible to traders in Africa. In this article, we are taking a look at some of the best forex brokers that accept mobile money.

The Mobile Money Landscape in Africa

The rise of mobile money services can be attributed to a number of factors. One of the main reasons mobile became so popular in Africa is limited access to traditional banking infrastructure. A growing mobile phone penetration rate greatly aided in growing the popularity of mobile money systems in the continent. This revolutionary technology was pioneered by M-Pesa in Kenya in 2007. From there, mobile money gained widespread acceptance, empowering millions of Africans to access basic financial services.

Today, almost every country in Africa has at least one mobile money payment system operating within its borders. Mobile money services such as Airtel Money, MTN, M-Pesa, EcoCash, and Orange Money have become integral parts of people's daily lives. As such, it is easy to see why some brokers now support mobile money as a payment system. Let’s look at some of the best brokers that do that in Africa.

Best Forex Brokers That Work with Mobile Money

Exness

Exness is one of the most reputable brokers in the market that supports a number of mobile money systems. This broker supports mobile money systems such as M-Pesa in Kenya, Uganda, and Tanzania and Airtel Money in Kenya, Uganda, Ghana, Tanzania, and more. Payment systems such as MTN MoMo are available for countries such as Ghana, Nigeria, Cameroon, Zambia, and Uganda. Exness promises to process all transactions instantly meaning traders can start trading as soon as possible. The minimum deposit on this broker site is a low $10.

Once the deposit is reflected in a customer’s account, they can then start trading a variety of market instruments. Specifically, traders can invest in CFDs on forex, indices, commodities, cryptocurrencies, and stocks. Notably, traders have access to some of the best trading platforms in the world. These include MetaTrader 4, MetaTrader 5, Exness Terminal, and Exness Trade App.

Further, Exness features five different accounts including two standard accounts and three professional accounts. The two standard accounts both feature spreads as low as 0.3 pips for major currencies with no commission. The professional accounts feature zero spreads for the zero and the raw spread accounts. However, these accounts feature commissions of $0.2 upwards for the zero account and $3.5 per side per lot for the raw spread account. The pro account simply features low spreads from 0.1 pips with no commission paid.

On regulations, Exness has good standing. The broker has regulatory oversight by the FSCA in South Africa, the CMA in Kenya, the FCA in the UK, and the CySEC in Cyprus, among others.

XM.com

XM is another well-known forex broker that supports a variety fo mobile money systems. This broker supports M-Pesa, Airtel Money, and MTN MoMo as payment options. This makes mobile money deposits available for traders in Kenya, Uganda, Tanzania, Zambia, Cameroon, Ghana, and Nigeria, among others. The minimum deposit with this broker is a mere $5.

Once a trader makes a deposit, they gain access to over 1,000 different market instruments to invest in. This allows investors to spread their risk across multiple markets on the same trading account. Particularly, investors can trade CFDs on forex, cryptocurrencies, indices, stocks, precious metals, and energies.

Further, the spreads on the XM broker site are reasonably low starting from 1.0 pips on the standard and the micro account. The XM ultra low account features even lower spreads from as low as 0.6 pips for major currencies with no commission. The shares account charges a commission that depends on the asset and the size of a trade.

The regulatory status of a company is paramount to look at. Luckily, XM has good standing in this category. The broker operates under the regulation and supervision of the FSC in Belize, the ASIC in Australia, and the CySEC in Cyprus.

Pepperstone

Pepperstone is yet another broker in Africa that supports mobile money. This broker accepts a plethora of payment systems, one of which is M-Pesa. This payment option is available for traders in Kenya, Tanzania, and Uganda. This means that traders do not need a bank account to make a deposit and start trading. Better yet, there is no minimum deposit requirement on Pepperstone. Traders can start investing with whatever amount that they have.

There are over 1,200 different market instruments on this broker site. These include CFDs on forex, cryptocurrencies, indices, stocks, commodities, and ETFs. This ensures that traders can invest in more than one market on the same broker site. Positively, these traders have access to four different world-class trading platforms with Pepperstone. These include MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Positively, Pepperstone features reasonably low spreads when trading. The standard account of this broker has spreads that start from as low as 1.0 pips with no commission required. On the other hand, the razor account has spreads from as low as 0.0 pips with a commission depending on the platform a trader uses. The commission is $3.5 per side per lot when using MT4, MT5, and TradingView. In contrast, the commission is $3 per side per lot for cTrader clients.

Finally, the regulations of this broker are stellar with licenses in various jurisdictions. These include regulations by the CMA in Kenya, the FCA in the UK, the ASIC in Australia, and the DFSA in the DIFC, among others.

IQ Option

IQ Option supports two main mobile money payment systems, M-Pesa and Airtel Money. These options make it possible for traders in Kenya, Uganda, Tanzania, and Nigeria to fund their accounts using mobile money. Luckily, traders can start investing with this broker from a low entry point of just $10.

Notably, this broker features a variety of global market instruments for traders to invest in. These include CFDs on forex, commodities, cryptocurrencies, ETFs, indices, and stocks. In total, there are over 250 different assets to invest in which allows investors to spread their investment capital. Moreover, the spreads offered by IQ Option are industry-standard starting from 1.0 pips for major currency pairs with no commission required. The only trading platform available to use is the proprietary IQ Option platform which balances between being powerful and intuitive enough for all kinds of traders.

FXTM

FXTM traders in Africa can make mobile money deposits using MTN MoMo and Airtel money. These take care of traders in Nigeria, Uganda, Ghana, Zambia, and Cameroon, among others. With a low minimum deposit of $10, this broker increases market accessibility for traders in Africa. Once traders make a deposit, they gain exposure to a variety of market products.

This broker allows its clients to trade forex currency pairs, commodities, metals, indices, stocks, forex indices, stock baskets, and stock CFDs. Evidently, the collection of market instruments on this trading site is deep. This deep collection of market products is available to trade on MT4, MT5, and the proprietary FXTM Trader.

Further, there are various accounts that traders can choose from. These include the micro, advantage, and advantage plus. The spreads that traders enjoy depend on the account a trader chooses. The micro and the advantage plus account both feature spreads as low as 1.5 pips with no commissions paid. On the other hand, the advantage account has spreads from 0.0 pips with a commission between $0.4 to $2 based on volume.

On regulations, this broker’s activities are under the supervision of the CMA in Kenya, the CySEC in Cyprus, and the FCA. While regulations alone are not enough, it is always a safer bet to trade with a broker with regulations from reputable organizations.

Benefits of Brokers That Accept Mobile Money

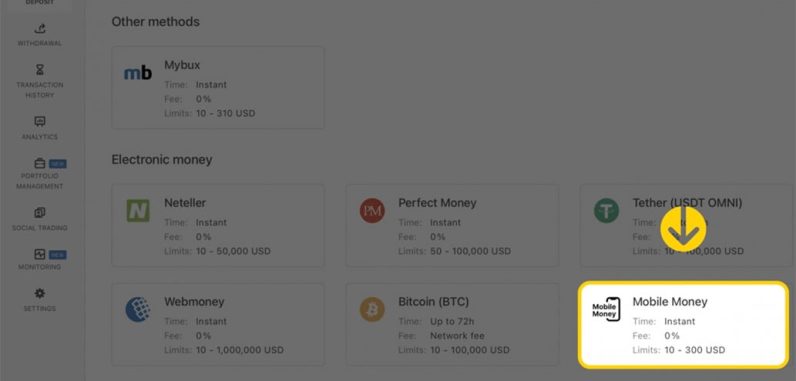

Evidently, there are many advantages associated with using mobile money to make deposits to broker sites. The main advantage still remains the convenience and accessibility offered by these brokers. In this review, we looked at some of the best brokers that accept mobile money in various African countries. To make our selections, we considered five key features.

These include the mobile money systems they support, the countries they operate in, the trading instruments available, the spreads, and the trading platforms they offer. Further, we considered the regulatory statuses of the various brokers. Needless to say, this is not an exhaustive list. As such, we encourage each trader to consider their own needs and pick a broker that best suits them.