HERE IS A LIST OF FOREX BROKERS WITH THE BEST TRADING APPS

Best Forex Trading Apps in South Africa

Every broker in the market today is looking to attract the most clients it can. One of the best ways to do this is by supporting clients on all kinds of devices. Even better, a broker that provides an advanced trading platform suitable for both beginners and experienced traders is bound to attract a lot of customers.

Today, we are looking at some of the best forex trading apps in South Africa. While we do this, we are also going to look at the regulations and the trading conditions offered by the brokers. These are crucial features to consider when selecting a reputable broker to trade with. Providing a trading platform is simply not enough. Using this criteria, here are our picks for the some of the best forex trading apps in South Africa.

9 Best Forex Trading Apps in SA

FP Markets

Trading Forex and CFDs entail risk.

Your capital is at risk.

FP Markets is a popular forex and CFDs provider that was founded in 2005. The company is under the regulation and supervision of the FSCA in South Africa, the ASIC in Australia, and the CySEC (based in Cyprus) in Europe. This broker allows clients to trade forex alongside CFDs on shares, metals, commodities, indices, cryptocurrencies, bonds, and ETFs. The minimum deposit to start trading with this broker is $100 AUD or equivalent, which is roughly 1240 in ZAR. South African clients trade with a fairly high leverage of 1:500. Spreads can go as low as 0.0 pips depending on the account a client is on.

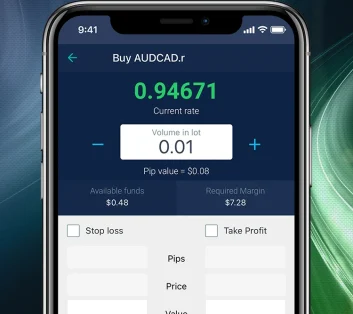

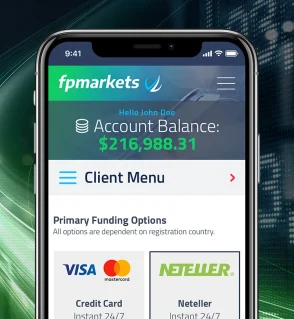

FP Markets mobile app is available on both Google Play and the App Store for Android users and iOS users respectively. The Android version combines the best of MT4 and MT5 into one platform. On the other hand, the iOS version is the company’s twist on the famous cTrader. These mobile apps offer fast execution and a variety of tools to support investors as they trade.

Pepperstone

Trading Forex and CFDs entail risk.

Your capital is at risk.

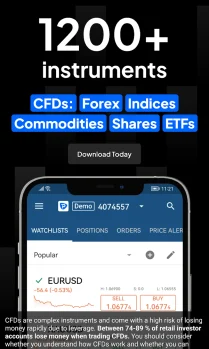

Pepperstone is a CFDs provider that offers over 1,200 CFDs from a variety of global markets. Clients of this broker can trade CFDs on forex, indices, commodities, ETFs, shares, and currency indices. These instruments are available to trade on a variety of world-class trading platforms. These include the Pepperstone cTrader app, TradingView, MetaTrader 4, MetaTrader 5, and cTrader. There is no minimum deposit and hence clients can deposit any amount and start investing.

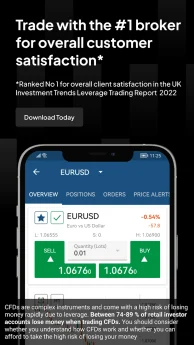

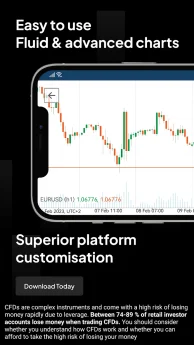

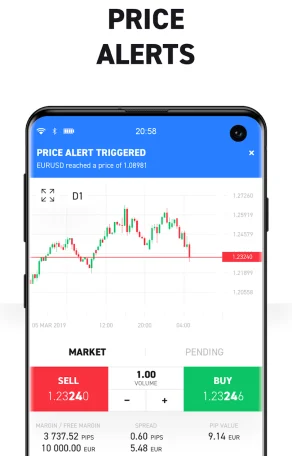

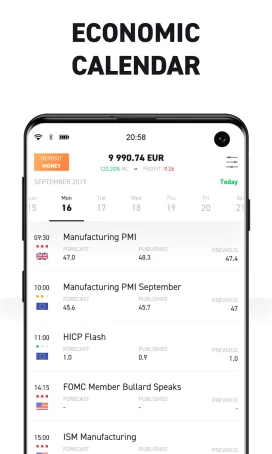

Pepperstone’s cTrader app delivers clients a Direct Processing and a No Dealing Desk mobile platform. This platform comes with sophisticated technical analysis tools including 65 popular technical indicators. Additionally, this platform features price alerts, trade statistics, session management, and a symbol watchlist. Clients can also get insight into how other people are trading using the sentiment indicator tool on the Pepperstone cTrader app.

The spreads that clients enjoy depend on the account they are using. The standard account features spreads as low as 1.0 pips for major currency pairs. On the other hand, the razor account has spreads that fall to 0.0 pips and a commission of $3.50 per lot.

Exness

Trading Forex and CFDs entail risk.

Your capital is at risk.

Exness was founded in 2008 and is currently one of the most popular brokers in the world. Today, it probably has the largest trading volume among all brokers. Exness provides its clients with a mobile trading app, the Exness Trade app, available for both iOS and Android. This app provides a state-of-the-art trading terminal powered by MetaTrader. There are a variety of tools available to traders on this app. These include an asset watchlist, advanced charting tools, price alerts, and notifications. Plus, the company promises clients ultra-fast execution when using this app.

With the Exnes Trade app, clients can trade currencies, stocks, gold, oil, indices, and more. The minimum deposit for South African traders is 170 ZAR and the company supports instant deposits and withdrawals. There are five different accounts clients can choose from on this broker site. There are two standard accounts one of which is a standard cent account that allows investors to trade on a cent-based model. These accounts are primarily spreads-based with spreads starting from 0.3 pips. Additionally, there are three professional accounts with spreads starting from 0.0 pips and different commissions involved.

XTB

Trading Forex and CFDs entail risk.

Your capital is at risk.

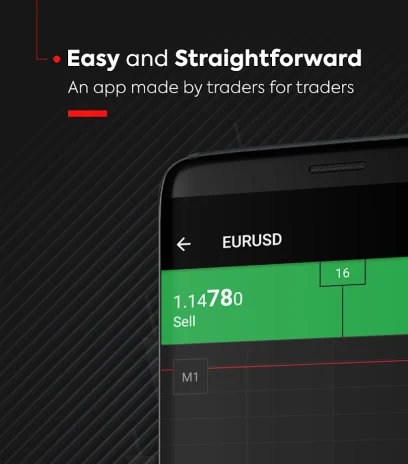

The XTB Online Trading application is only available for android users. Still, it is one of the best mobile trading applications in the market. This mobile application allows clients to trade over 2,100 different instruments. These include CFDs on forex, indices, commodities, equities, cryptocurrencies, and ETFs. Typical spreads on this trading platform can fall as low as 0.35 pips for major currency pairs on the standard account. These are some of the lowest spreads in the market today.

Additionally, this mobile trading application comes with a plethora of features. These include advanced charts, a trader’s calculator price alerts, and market news and analysis. These features are in place to assist investors to make better trading decisions and improve their trading strategies. XTB’s mobile application offers fast order execution ensuring orders are filled at the best prices with no requotes.

XM.com

Trading Forex and CFDs entail risk.

Your capital is at risk.

XM has one of the largest customer bases from over 196 different countries. This company is under the regulation of several organizations including the CySEC in Europe, the ASIC in Australia, and the FSC in Belize. This broker avails over 1,000 CFDs on forex, stocks, indices, shares, energies, cryptocurrencies, and precious metals. The minimum deposit on this broker site is a mere $5 which is equal to 70 in ZAR. Spreads can go as low as 0.6 pips on the standard account.

The XM trading app provides an MT5 environment for clients to manage their trading accounts and trade the company’s full range of instruments. The app is available to download for both iOS and Android. It comes with up-to-the-minute charts, over 90 trading indicators, instant order execution and no re-quotes. Further, the application brings clients the latest news, analysis, and market research straight to their phones.

Forex.com

Trading Forex and CFDs entail risk.

Your capital is at risk.

Forex.com provides clients with a great trading app available on both the App Store and Google Play. This trading app comes with a variety of trading tools. These include one-swipe trading, advanced charting, real-time news, performance analysis, SMART signals, and more. Clients can even identify correlations by overlying multiple markets onto a single chart.

There are over 5,500 different instruments for clients to invest in. These include CFDs on forex, stocks, commodities, indices, cryptocurrencies, and precious metals. The spreads on the standard account can go as low as 0.8 pips for major currency pairs. On the other hand, the Commission account and the Direct Market Access (DMA) account both charge a commission. The commission account features spreads starting from 0.2 pips and charges a commission of $5 per 100k traded. The DMA account charges different commissions depending on the trading volume of a client. For example, a trader with a trading volume of $0M – $100M per month would pay a commission of $60 per $1 million traded.

AvaTrade

Trading Forex and CFDs entail risk.

Your capital is at risk.

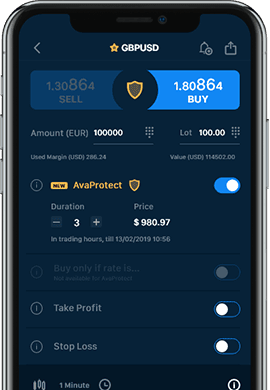

AvaTrade offers clients a variety of trading platforms to choose from. These include MetaTrader 4, MetaTrader 5, and AvaTradeGO. For mobile users, AvaTradeGO is the main platform they can use to place orders on various market instruments. This trading app is in-house-built and comes with a lot of trading tools. This trading app offers clients a full MetaTrader trading suite for both MT4 and MT5. On top of that, it comes with technical indicators, forex quotes, and advanced charts. Plus, clients can protect their trades up to one million dollars with AvaProtect.

Investors can trade assets from a variety of markets including forex, stocks, indices, cryptocurrencies, ETFs, forex options, metals, energies, commodities, and bonds and treasuries. The spreads for trading on the AvaTrade app are fairly low, falling as low as 0.9 pips for major currency pairs. The minimum deposit sits at $100 on AvaTrade and the company does not charge any deposit or withdrawal fees.

Fxview

Trading Forex and CFDs entail risk.

Your capital is at risk.

Fxview is one of the best brokers that operate in South Africa. The broker provides clients with over 450 different market instruments to invest with. The Fxview droid app allows clients to trade forex and CFDs on currencies, commodities, cryptocurrencies, indices, and stocks. To assist clients while trading, the app comes with 48 different indicators and 11 different analytical objects. It also has 11 different timeframes on the charting tools.

Fxview is very transparent about the fees that apply when trading. As an ECN broker, the spreads on this platform are ultra-low, starting from 0.0 pips. However, like on other ECN brokers, a commission applies when trading. Clients here pay a commission of $1 per 100k traded. This is a competitive commission compared to the rates offered by other brokers in the market.

Tickmill

Tickmill is a global broker that was founded in 2014 and has regulations in South Africa by the FSCA, in the UK by the FCA, and in Cyprus by the CySEC. This broker offers clients a proprietary application with ultra-fast execution and all strategies supported including hedging and scalping. Clients can also use EAs with this forex trading app. There are two main versions of the application, CQG and MT4. Both of these versions allow clients to trade CFDs on forex, stock indices, metals, bonds, commodities, and cryptocurrencies. The spreads for trading these instruments on this app start from 0.1 pips for major currency pairs.

Seemingly, Tickmill claims to stand out from the rest because of its pioneering technology. The company promises ultra-fast execution times, usually under 0.3 seconds on average. Additionally, the company boasts of having no requotes whatsoever.

Advantages of Trading With a Mobile App

Mobile trading apps are necessary tools for traders at this point. People want to access their portfolios and market instruments on the go. As the market is fast-moving, traders desire to have top accessibility so they can react to market events in the fastest time possible. Evidently, the advantages of providing a mobile trading app by a broker far outweigh the disadvantages. However, providing a mobile app is not the only thing you should consider about a broker. There are other important features that include regulations and trading fees to consider. Make sure the broker of your choice best suits your trading needs regardless of whether they provide a trading app.